More info on Park Rag… and Come Write With Us.

We’ve received some great feedback over the past few weeks and wanted to let you know about some changes at Park Rag.

First, if you want to know more about who we are, why we are doing this, what our history is, and what we are trying to accomplish please check out our About Park Rag page. We’ve updated it with more info.

Second, we want to hear from more voices in our community. That’s part of the definition of Citizen Journalism So, we’ve added a Write With Us section that will explain how you can start writing at Park Rag. Don’t worry if you’ve never written much. It is the essence of the ideas that are important. We definitely aren’t Grammar Stalins, so please let your lack of knowledge of dangling participles stop you. We sure haven’t.

Thanks again for checking out the Park Rag. We are really starting to feel like we can make a difference in Park City and that’s because of you.

Why the Game Lemonade Stand Still Makes Me Wonder Who Will Get Screwed on Vail Sales Tax Revenues

Remember the old computer game Lemonade Stand? Nostalgia. Now, let’s use that to demonstrate why there still isn’t a good explanation of how Epic Pass taxes will be divvied up between Summit County and Park City.

In Lemonade Stand, you make choices about prices and marketing to achieve success in the sugar-water business. Let’s complicate it by adding sales tax to it. We’ll start with you owning one lemonade stand in Lemonsville. Lemonsville has a 5% sales tax. You decide to make it easy on your customers and sell your lemonade for $1. You’ll simply subtract the tax out of the total. Sally comes up to buy a $1 glass of lemonade, pays $1.00, and about 5 cents of that is sales tax. The state will take their share of the 5 cents and Lemonsville gets the rest.

Your lemonade stand is doing great but you decide to take it into the 21st century sell an “all-you-can-drink” pass from your stand for $100. Sally loves the idea and comes and buys a pass from your stand. She pays $100.00, and about $5 of that is tax. The state takes their share and Lemonsville gets the rest.

Darn, your family has to move out of state. You are moving to Sugartown but you want to keep your lemonade stand open. So, you make a website to sell your passes and hire some of your classmates back in Lemonsville to run it. Passes are still $100 and Chip from Lemonsville buys the first one. He pays $100.00. The tax is still $5 because although your website is physically out of state in Sugartown, your lemonade stand is still in Lemonsville. That $5 goes to the state, they take their share, and Lemonsville gets the rest.

You are now rolling in the dough and decide to expand by buying someone else’s limeade stand in the neighboring town Lime City. Now you have a lemonade stand in Lemonsville, a limeade stand in Lime City, and you live in a completely other state. How are you going to maximize your profit? You decide to offer your “all-you-can-drink-pass” for $100 and make it work both for lemonade and limeade at your two stands.

Your accountant decides he better call you. He tells you that while Lemonsville’s sales tax is 5%, Lime City’s sales tax rate is 10%. So, you better account for it correctly. You say no problem. If someone buys a pass at my lemonade stand I’ll charge them 5% and if they buy the pass at my limeade stand, I’ll charge them 10% sales tax. Your accountant asks what rate you’ll charge if someone buys it online. You pause and say…uh…uh….

“I’ll divide that out based on which stand they use the pass at each time.” Your accountant replies, “how do you know how many times this year they are going to stop at your stand?” He continues, “so if they come once in June, what are you going to send to the state on June 30? All of it?” You reply “no”. “I’ll send some in July and the rest in August.” The accountant then says “what if that person never comes back in July? How much will you send?”

So, you ask your accountant what to do. He reminds you that you have included tax in your pass price and Lime City taxes costs more. He says it would be financially smart to find a way to make more taxes come through Lemonsville. He says you’ll make $5 more on every pass sold through Lemonsville. You think and think and think about a way to make it defensible to have Lemonsville taxes be collected a majority of the time. You decide to collect tax at the first place the pass is used. Your lemonade stand is bigger, opens earlier, and has more customers than your limeade stand. You might not save every penny but at least you’ll make more! And indeed you do.

Lime City is not happy but what can they do? Their sales tax revenues are down and they don’t have as much money as when the limeade stand was run locally. They talk to their accountant. He says “maybe you should have written to the State Tax Commission and got a ruling before this all started”. They say, “seriously, what should we do now?”. He responds, “Well, I guess you could raise taxes”.

Park City is Paying 60% Commission on Ad Sales at The Ice Rink?

If you’re a local real estate agent your commission is probably 1%-2% of your next transaction. If you sell cars, you’ll probably get 25%-30% of the profit on your next sale. If you are doing general sales work, pounding the pavement, you’ll likely receive 30%-40% commission on your next deal. If you have the contract for ad sales at the Park City Ice rink, your commission rate makes those look like chump change.

On Thursday, the Park City City Council will be voting on renewing a contract for the sale of advertising space and program sponsorships at the Park City Ice Arena. Matthew Senske, a former Ice Arena employee, was awarded the contract in late 2012. His company, Senske LLC, signed the contract in April 2013. Senske was required, and met, a target of $20,000 in sales during the first 6 months. It is also likely Senske will meet his 18 month target in October 2014. What will Senske LLC make on each sale of ads or sponsorships at the rink? 60%.

According to documents created by the Ice Rink, Senske LLC has sold about $56,240 of ads through August. The company needs to sell an additional $3,760 this month to hit the goal of $60,000 of sales in 18 months.

By all measures, it seems like Senske LLC has done a decent job. It also appears like there weren’t many proposals to initially choose from in 2012. Finally, it also seems like Senske LLC is the type of company Park City would like to support, with a US bob sledder at its helm.

However, these are also public funds at play. The Ice Rink is poised to expand with approximately $2.5 million more in funds if a bond initiative passes in November. This means each Summit County home owner and business will pay more in property taxes. If that’s the case, we as citizens need to demand that our money is being used wisely.

While perhaps in 2012, with few takers, the Ice Rink had to pay 60% commissions in order to find anyone who would be willing to sell their advertising. However, it is now two years later. The economy has improved and businesses are looking to expand. To be frank, a 60% commission seems absurd. It would be shocking if there wasn’t a qualified person or company that would take this on for a 40% commission and still meet the goals. Due to local ties, we would hope that company is Senske LLC. If not, we aren’t excited about the city throwing money away, especially when more is being asked from their citizens already.

Thanks!

Just wanted to thank the person who just helped with the “Submit A Tip Page”. We really appreciate the feedback.

This Week’s Summit County Manager’s Report (one of the best sources of info of what’s happening in Summit County government).

The Summit County Manager’s Report is published every 1-2 weeks and tells you what your Summit County government departments are working on. It includes information about everything from planning applications to legal matters. There is usually something interesting included.

Are Park City’s kids college ready? Better than most but not perfect.

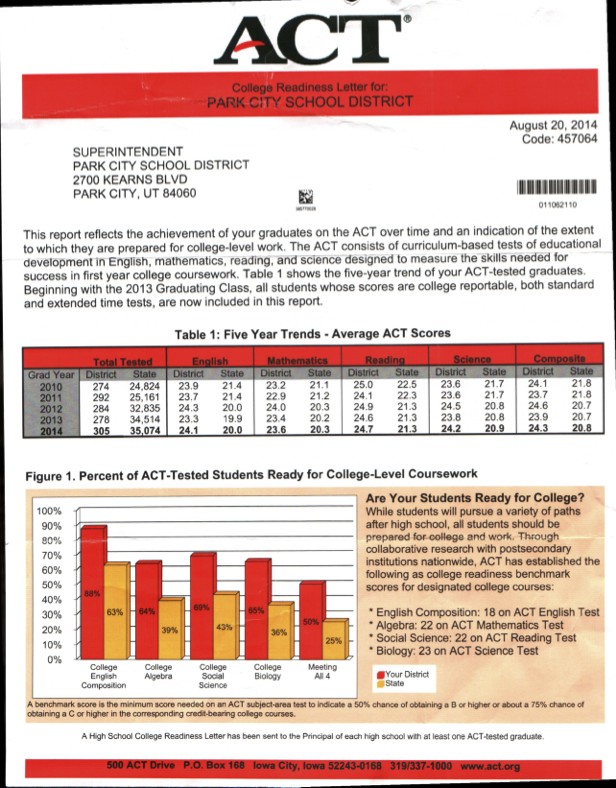

The Park City School District published the 2014 College Readiness Letter from ACT, an organization that provides a standardized test used by many colleges as a factor in admittance. The really encouraging news is that Park City students were about 25% more prepared for college classwork than their counterparts in other Utah schools. The results varied from 88% of students being college ready in English Composition to 64% being ready in Algebra.

The results get a little more concerning when ACT combined all 4 major areas to determine readiness. In that case 50% of Park City students are college ready in the 4 major areas of english, math, social science, and biology. That’s still far above the state average of 25%.

So relatively speaking, Park City is preparing its students for college. However, about half of all students appear to need to up their game in at least one area once they arrive at university.

Do You Want Manufacturing, Office Space, Townhomes, and Assisted Living Between Jeremy Ranch Elementary and Burt Brothers?

A developer is requesting input from the Planning Commission around using almost 11 acres acres of land between Jeremy Ranch Elementary School and the Burt Brothers for manufacturing, office space, an assisted living facility, and town homes.

This use is not currently available via the General Plan; however, a Specially Planned Area (SPA) could be approved that would enable this to be built. The Planning Commission is currently discussing amendments to the General Plan, that could make something like this a reality, without any requirement for SPA exceptions.

You can read more about this concept by clicking here. If you have concerns you would like to voice, you could either attend Tuesday’s meeting at 6PM at the Richins Library in Kimball Junction (public comment may be taken) or you can email the Planning Commissioners below. If you were going to contact one person, Colin DeFord is probably the best choice.

| Member Name | ||

| Colin DeFord – Chair | ||

| Mike Franklin – Vice Chair | ||

| Mike Barnes | ||

| Canice Harte | ||

| Chuck Klingenstein | ||

| Greg Lawson | ||

| Bea Peck |

Park City’s Balloon Fest Is Good for the Soul

Standing in the middle of ten balloons, all getting ready to take off, you can’t help but look around. You gaze in amazement at these huge, multi-colored balloons decorated like frogs, pumpkins, and gremlins, gently lifting and ready to break their earthly bonds. Your eyes then drift to the people around you and then a little farther. Everywhere you see… people…heads pointed up, eyes as wide as a child on Christmas morning, and smile after smile after smile. It’s 8AM on a Saturday morning and you don’t see a soul who doesn’t seem to be enjoying this.

It truly seemed like a cleanse for Park City. Whatever problems, troubles, or worries that people came with, they got left in the parking lot. There were neighbors sharing bagels. There were friends holding babies. There was a sense of calm and wonder and happiness that many of us haven’t felt in a long time.

Some people say chicken soup is good for the soul. I say balloon festivals are even better. I would attend one very month just for the pure joy I experienced and what I saw around me. I know it’s been 20 years since the last festival here. Maybe that’s what we’ve been missing.

There is hope. You Can Still Make A Difference in Summit County

If you pay attention to events in Washington D.C., you’ll know that our congress people have an approval rating of about 10%. People look at what is going on around them and feel they have no input; no way to change the course of events. They then extrapolate that despondence onto the events they see closer to home. Recently we have heard things like “the school board is going to raise our taxes again, but there is nothing I can do about it” and “Vail is going to take over this place and Park City is just going to let them”. Yet, if you look at some people trying to make a difference, you will find that the reality, at least on the local level, is far different.

There is no better example than an issue that is starting to simmer in Jeremy Ranch. There is a developer who has the right to build offices and small-retail on 66,000 square feet across from the Jeremy Store. However, the developer is requesting this be expanded 4-fold to about 235,000 square feet with homes, a hotel, and retail space. The Jeremy Ranch Home Owners Association marshaled home owners and brought them to a Summit County Council meeting on Wednesday in Coalville to speak against the issue. The County Council wasn’t prepared to discuss the issue, as it was on the next week’s agenda.

However, a number of very good things happened:

- The County Council pushed the agenda item back a week, so that it could be held in Kimball Junction, instead of Coalville. This enables more of the public impacted to participate.

- The Community Development Director Patrick Putt provided his email and his phone number (yes his phone number) to everyone in attendance and wanted everyone to feel free to call him or email with any questions they have. You don’t see that every day.

- The County Council educated people in attendance on how to use the new Summit County website to sign up to receive emails, so they can stay on top of not only this issue but others ones.

What the people of Jeremy Ranch got was hope and a way forward. They found a local government that was willing to work with them and make it as easy as possible for people to make their case.

While impacting anything at the national level is unlikely for us mere mortals, at least the people of Jeremy Ranch have an even shot. It is possible to make a difference if you just try. Whether your issue is Vail, land use, dogs, or really anything else, at least Summit County seems willing to listen and consider your argument. That’s about all any of us can ask.